The ASX Is Underperforming For A Reason. Just Not The One You Think.

The Australian equity market isn’t just lagging global peers; it’s structurally out of sync.

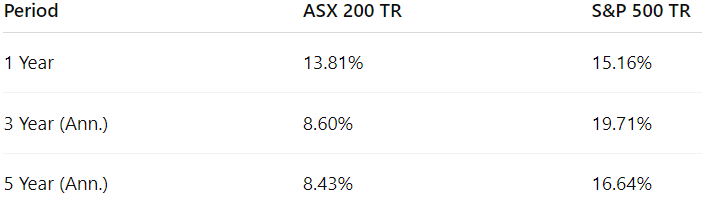

For the 12 months to June 30, 2025 (FY 2025), the ASX 200 returned +13.81% on a total return basis. A solid number at first glance, until you compare it to the S&P 500’s +15.16% over the same period. Over a three- and five-year horizon, the gap is even wider.

Over a five-year horizon, the S&P 500 has doubled the annualised returns of the ASX 200.

The Problem Isn't Just Macro, It's Structural

Ask most pundits why the ASX lags and you’ll hear familiar refrains:

• The RBA is behind the curve

• The economy is interest-rate sensitive

• China is slowing

• Wages are sticky

• Migration-driven inflation

There’s truth to all of these, but they miss the bigger structural issue.

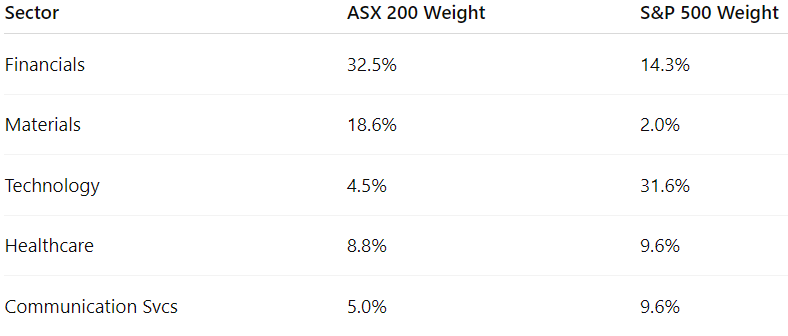

The ASX 200 is overweight to yesterday’s economy. Financials and commodities make up over 50% of the index. Meanwhile, technology accounts for less than 5% of the ASX, compared to ~30% in the S&P 500.

Australia is structurally underweight the sectors driving global returns.

Top-Heavy and Narrow

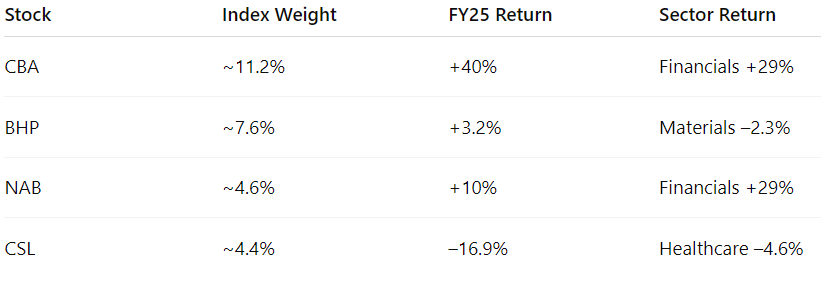

Four stocks (CBA, BHP, NAB, and CSL) represent nearly 30% of the ASX 200. Their individual performance has outsized effects on index-level returns.

The ASX’s strength in FY25 was largely driven by CBA’s outperformance. Its outsized performance was both a gift and a trap. Many active fund managers stayed underweight, citing valuation concerns. But as the AFR reported, this decision cost the 15 largest Australian equity managers roughly 2 percentage points of underperformance in FY 2025. In an index this top-heavy, ignoring one stock can sink your entire relative return.

Passive Flows Reinforce the Problem

The rise of passive investing magnifies this concentration. As ETFs track the index, they allocate proportionally more capital to the top names, creating a reflexive loop. CBA rallies, more flows follow, and CBA’s weight increases. But this does little to reflect real economic breadth or innovation.

Imperfect Hedge View

The ASX 200’s structural concentration, both sectoral and stock-specific, limits its global competitiveness and diversification. We remain structurally underweight the index, favouring better risk-reward opportunities in selective U.S. technology names, Emerging Markets with structural tailwinds, and capital-efficient European heavyweights.

As a firm, we are not benchmark-aware, nor constrained by home bias. We don’t need to be in Australia, and when we are, it’s on a bottom-up basis with a defined edge. For investors seeking Australian equity exposure, a low-cost index ETF likely offers a better alternative to high-fee, underperforming, benchmark-hugging active managers.

The index isn’t broken. It just reflects a different economy than investors increasingly want exposure to. That dislocation is both the risk and the opportunity.

Outperformance requires disentangling from the index itself.